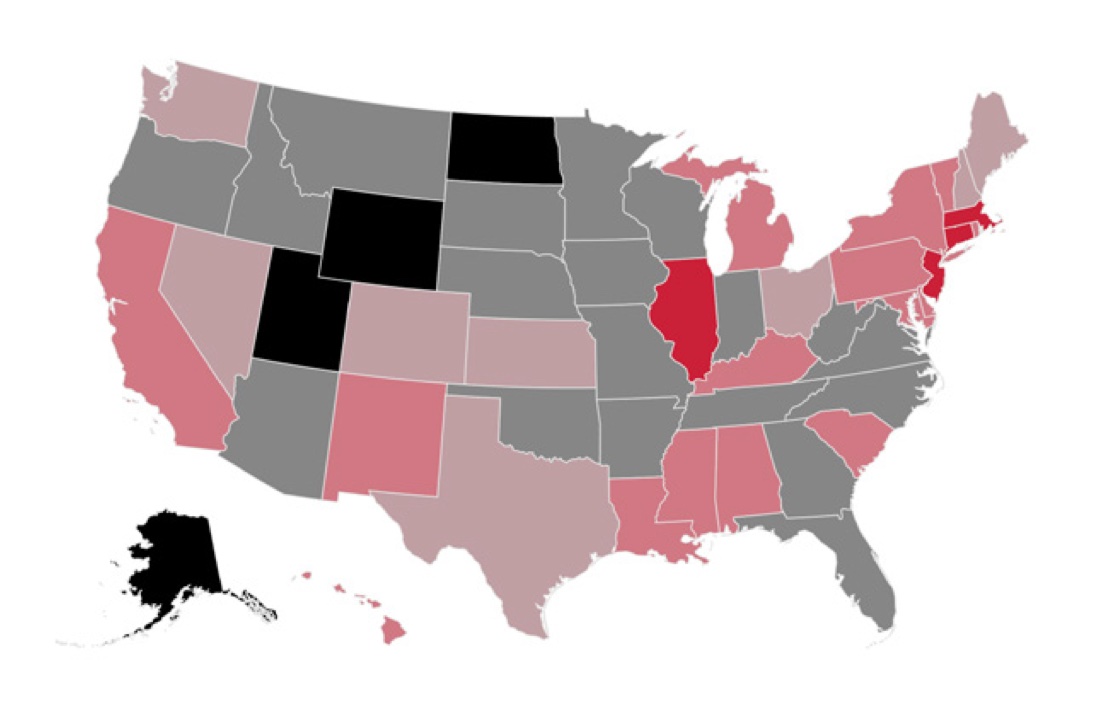

Half of America’s states don’t have enough money to cover their bills, according to the 16th annual Financial State of the States report from Truth in Accounting (TIA).

The fiscal watchdog found that 25 states ended fiscal year 2024 in the red, unable to meet all of their long-term financial obligations. The primary culprits: unfunded public pension and retiree health care promises.

Most of the states facing deficits are governed by Democrats.

“Rising costs, inflation, and ongoing pressure on budgets to fund promised pension benefits” continue to strain state finances, TIA noted. With federal pandemic aid now expired, many states are finding it harder to balance their books without new sources of revenue.

Except for Vermont, every state is legally required to balance its budget. But TIA says many do so only on paper—by deferring expenses and underfunding retirement systems. By the end of fiscal 2024, states collectively carried an $832 billion shortfall in pension funds and $514 billion in other post-employment benefits.

“The bulk of state debt stems from these unfunded retirement obligations,” the report said. “Taxpayers are on the hook for both their state’s current debt and any future debt their governments accumulate.”

TIA grades each state using two key measures: Taxpayer Burden™, which divides a state’s total shortfall among its taxpayers, and Taxpayer Surplus™, which measures the opposite. States are then assigned grades from A to F based on fiscal health.

Only five states each received an A or an F. Twenty earned Bs, seven earned Cs, and 13 received Ds.

The five worst “Sinkhole States” were:

- New Jersey (–$44,500 per taxpayer)

- Connecticut (–$44,500)

- Illinois (–$38,800)

- Massachusetts (–$24,900)

- California (–$21,800)

Other states with deficits include Delaware, Vermont, Kentucky, Maryland, Pennsylvania, Hawaii, New York, Texas, and Washington.

The five best “Sunshine States” were:

- North Dakota (+$63,300 per taxpayer)

- Alaska (+$48,500)

- Wyoming (+$27,200)

- Utah (+$14,400)

- Tennessee (+$10,900)

Twenty other states, including Florida, Virginia, and Iowa, also reported surpluses.

In total, states reported $2.2 trillion in assets but $2.9 trillion in debt at the end of fiscal 2024, a $765 billion gap. Most states’ fiscal years ran from July 1, 2023, through June 30, 2024.

Ohhhh! they have enough to cover community expenses. They just don’t want to cut themselves and their friends out of the budget.

Like Anchorage has more than enough taxpayer money to reconstruct and repave municipal roads without the need of charging double on the taxpayer by bonds and capital projects. IF municipal democrats cut government, non profits, public assistance out of its budget expenditures.

Bingo!